Running a restaurant is tough. It’s not just about serving great food or giving excellent service. Managing your finances is just as important. Without knowing how your restaurant is doing financially, you might face challenges like running out of cash, overspending, or even shutting down.

One way to stay on top of your finances is by understanding your restaurant’s financial statements. In this blog, I’ll walk you through what they are, the different types, and how they help your business.

What Is a Financial Statement for a Restaurant?

A financial statement for a restaurant is a document that shows your restaurant’s financial health. It tells you how much money you’re making, spending, and saving. Think of it as a report card for your business.

Financial statements help you answer important questions like:

- Are you making a profit or a loss?

- How much do you owe to suppliers or banks?

- Are you spending too much on food, rent, or salaries?

By keeping track of these numbers, you can make smarter decisions and avoid financial problems.

What Are the 5 Basic Financial Statements?

There are five basic restaurant financial statements you should know:

1. Income Statement

This is also called a profit and loss (P&L) statement. It shows your revenue (sales) and expenses (costs) over a period, like a month or a year.

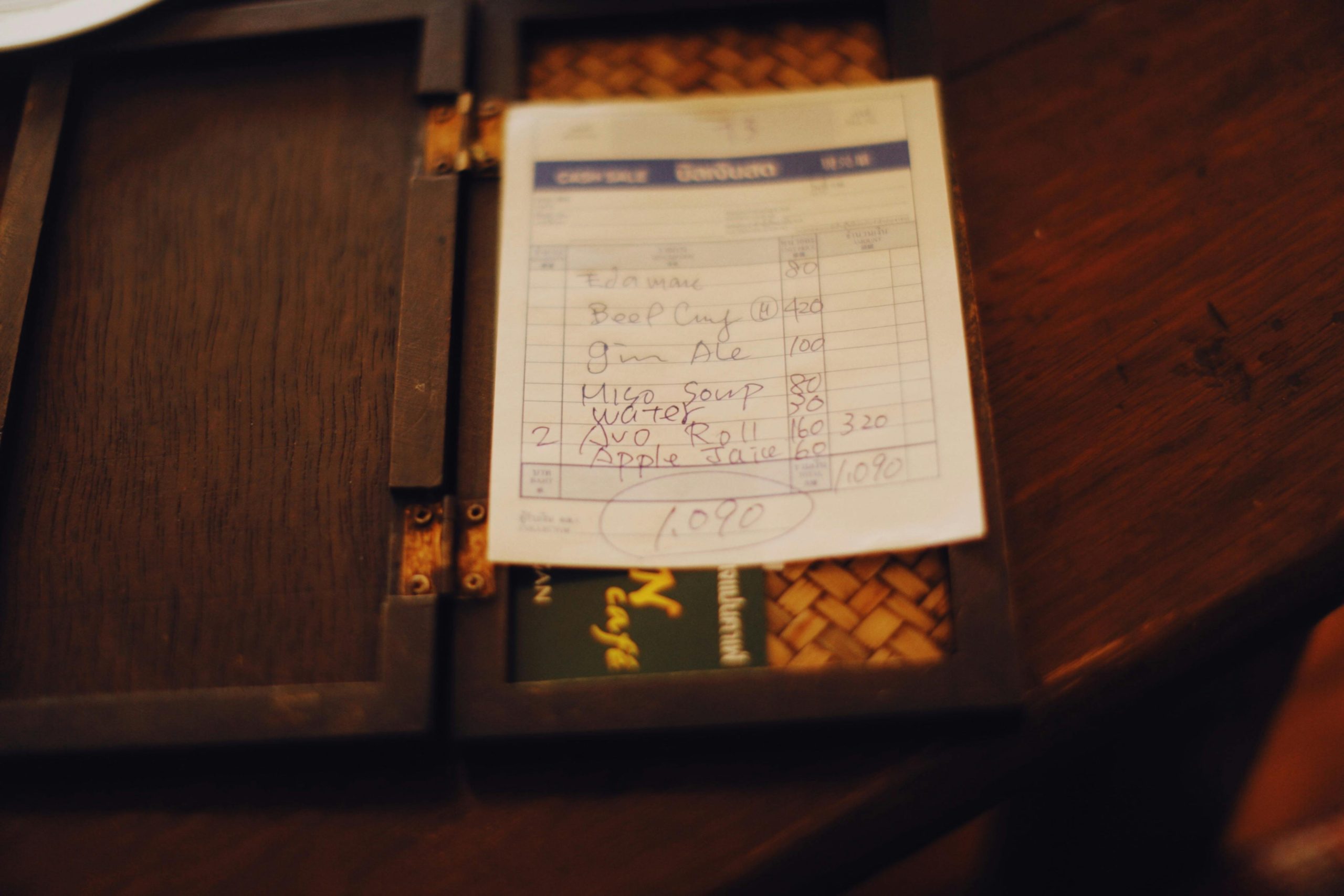

For example:

- Total sales from food and drinks: RM50,000

- Expenses (food cost, staff salaries, rent): RM40,000

- Profit: RM10,000

If you’re spending more than you’re earning, your income statement will show a loss. A healthy income statement means your restaurant is profitable.

2. Balance Sheet

A balance sheet shows what you own (assets) and what you owe (liabilities). It helps you see your restaurant’s overall financial position.

For example:

- Assets: RM100,000 (cash, equipment, furniture)

- Liabilities: RM60,000 (loans, unpaid bills)

- Equity (your ownership): RM40,000

This statement is useful when applying for loans or attracting investors.

3. Cash Flow Statement

This statement shows how money moves in and out of your restaurant. It covers three areas:

- Operating activities (daily sales and expenses)

- Investing activities (buying or selling equipment)

- Financing activities (loans or repayments)

A strong cash flow means you can pay your bills on time. For example, if your cash inflow is RM20,000 and your outflow is RM15,000, you have a net cash flow of RM5,000.

4. Statement of Changes in Equity

This statement shows changes in your ownership over a period. It includes your investments, profits, or losses, and any money you take out of the business.

For example:

- Starting equity: RM30,000

- Net profit: RM10,000

- Withdrawal: RM5,000

- Ending equity: RM35,000

This helps you see how your financial stake in the restaurant is growing or shrinking.

5. Notes to Financial Statements

These are detailed explanations of the numbers in your statements. For instance, if you bought new kitchen equipment, the notes will explain its cost and depreciation.

This section helps you understand the story behind the numbers.

Why Are Financial Statements Important for Your Restaurant?

Keeping track of your restaurant’s financial statements isn’t just about staying organized. It’s about growing your business. Here’s why they’re crucial:

- Control Costs

In Malaysia, food costs usually take up 28% to 35% of your revenue, according to industry benchmarks. If your food costs are higher, your income statement will alert you. - Track Performance

With regular updates, you can see if your sales are improving or declining. For example, if your sales dropped from RM60,000 to RM50,000 in two months, it’s a sign to rethink your strategies. - Get Loans or Investors

Banks and investors want to see your financial health before they give you money. A clean balance sheet or income statement shows you’re running a solid business. - Plan for Growth

Want to open another branch or expand your menu? Your financial statements will tell you if you can afford it.

How to Prepare Restaurant Financial Statements

Preparing these statements may seem overwhelming, but it doesn’t have to be. Here’s a simple guide:

- Use Accounting Software

Tools like Xero, QuickBooks, or Malaysian platforms like Wave let you track income and expenses easily. - Track Daily Sales and Costs

Use a POS (Point of Sale) system to track every sale. Record all expenses, including ingredients, rent, and staff salaries. - Hire an Accountant

If you’re too busy, hire a professional. A good accountant can help you prepare accurate financial statements and file taxes. - Review Regularly

Don’t wait until the end of the year. Review your financial statements monthly to spot any issues early.

Why Financial Statements Matter

Imagine this: You run a café in Kuala Lumpur. Sales have been steady at RM80,000 a month. However, your cash flow statement shows a problem. Even with high sales, you’re short on cash because of rising ingredient costs.

By reviewing your financial statements, you find that your food costs jumped from 30% to 45% of revenue. With this insight, you renegotiate prices with your suppliers and change your menu to include more cost-effective dishes. Within two months, your cash flow improves, and you’re back on track.

Important Statistics About Restaurant Finances in Malaysia

- The average profit margin for restaurants in Malaysia is between 5% and 10% (Source: Statista).

- Food costs make up 28% to 35% of total revenue for Malaysian restaurants (Source: F&B Insights Malaysia).

- Labor costs typically account for 20% to 25% of revenue (Source: F&B Malaysia).

These numbers are benchmarks to help you measure your own restaurant’s performance.

Your restaurant financial statements are more than just numbers. They’re tools to help you succeed. By understanding them, you can manage costs, track performance, and make better decisions.

Start by preparing basic statements like the income statement and cash flow statement. Use software or hire an accountant if needed. And most importantly, review them regularly to avoid surprises.

Remember, running a restaurant isn’t just about great food and service. It’s also about keeping your finances in check. If you take control of your financial statements, you’ll be better prepared to grow and thrive in Malaysia’s competitive F&B industry.